Safeguarding Your Finances

How to Protect Yourself from Credit and Finance Corporation Scams

In the Philippines, access to credit and financial services plays a crucial role in helping individuals achieve their goals and aspirations. However, amidst the legitimate financial institutions offering loans and other services, there exist fraudulent entities seeking to exploit unsuspecting individuals. In this blog post, we’ll explore the importance of protecting yourself from credit and finance corporation scams and provide actionable strategies for safeguarding your finances.

Understanding the Threat of Credit and Finance Corporation Scams

Credit and finance corporation scams can take various forms, but some common tactics used by fraudulent entities include:

-

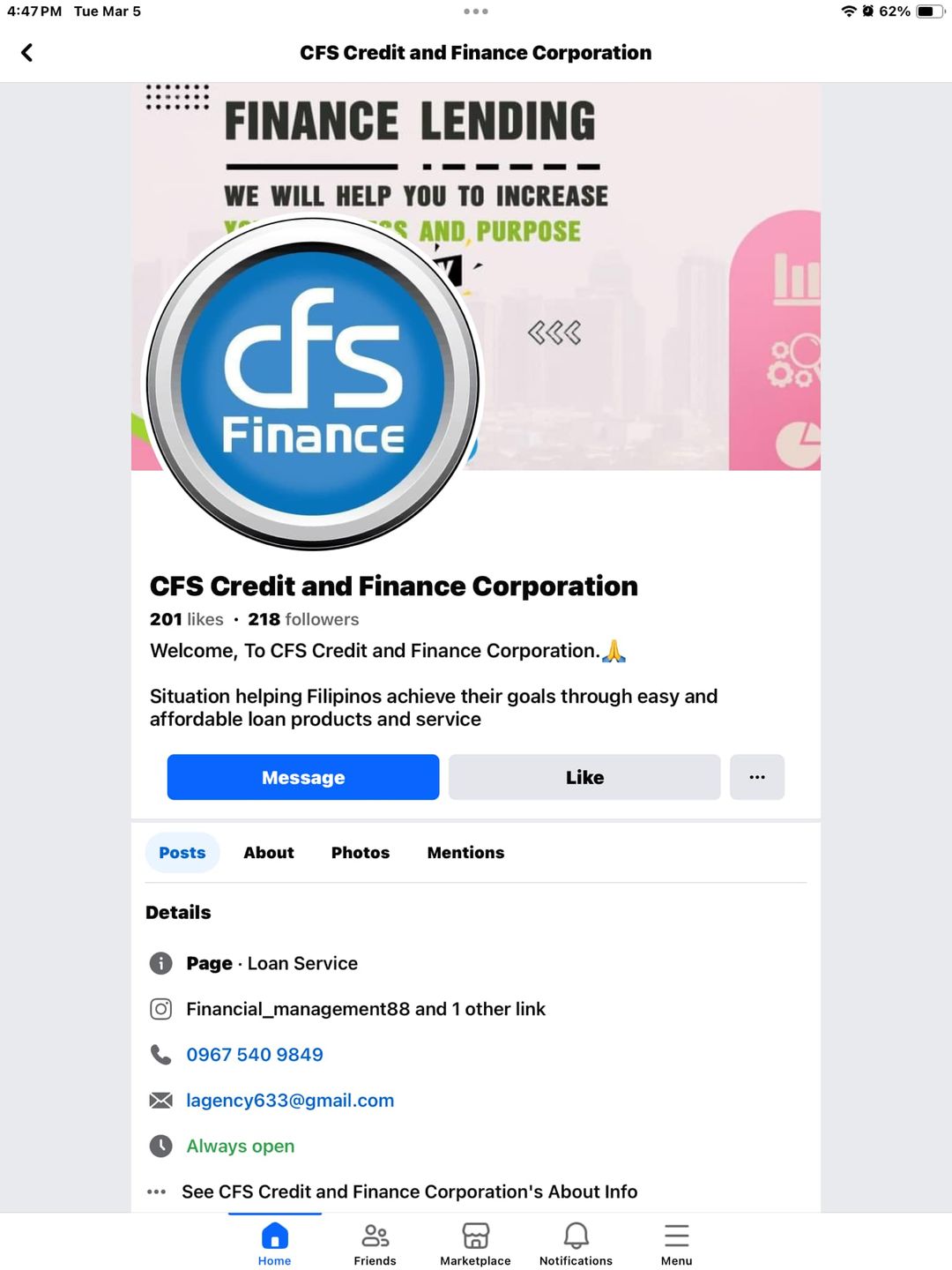

False Promises: Scammers may make false promises of easy and affordable loan products and services, luring individuals into applying for loans with unrealistic terms and conditions.

-

Phishing Attempts: Fraudulent entities may use phishing emails, calls, or text messages to impersonate legitimate financial institutions, requesting personal information or payment in exchange for loan approval.

-

Hidden Fees and Charges: Some scams may involve hidden fees and charges associated with loan processing, application fees, or insurance premiums, significantly increasing the overall cost of borrowing.

How to Protect Yourself from Credit and Finance Corporation Scams

To safeguard against credit and finance corporation scams and protect your finances, consider the following preventive measures:

-

Research Thoroughly: Before engaging with any credit and finance corporation, research the company’s reputation, customer reviews, and regulatory status. Verify their accreditation with relevant authorities such as the Bangko Sentral ng Pilipinas (BSP) or Securities and Exchange Commission (SEC).

-

Read the Fine Print: Carefully review the terms and conditions, interest rates, and fees associated with loan products and services. Pay attention to any hidden fees or charges that may apply and clarify any uncertainties before signing any agreements.

-

Verify Credentials: Ensure that the credit and finance corporation is duly licensed and registered to operate in the Philippines. Check for certifications and accreditation from reputable organizations to validate their legitimacy.

-

Protect Personal Information: Be cautious of sharing personal information, such as your Social Security Number (SSN), bank account details, or identification documents, with unfamiliar entities. Legitimate financial institutions will never request sensitive information via unsolicited emails or calls.

-

Use Secure Channels: When communicating with credit and finance corporations, use secure channels such as official websites, encrypted email, or verified phone numbers. Avoid clicking on links or downloading attachments from suspicious emails or messages.

-

Trust Your Instincts: If something feels off or too good to be true, trust your instincts and proceed with caution. Be skeptical of offers that seem overly generous or require immediate action without proper verification.

Credit and finance corporation scams pose a significant threat to individuals’ finances and personal information, but with awareness and vigilance, you can protect yourself from falling victim. By researching thoroughly, reading the fine print, verifying credentials, protecting personal information, using secure channels, and trusting your instincts, you can safeguard your finances against fraudulent entities. Stay informed, stay protected, and achieve your financial goals with confidence in the Philippines’ dynamic financial landscape.