Protecting Yourself from Medicare Scams

Safeguarding Your Health and Finances

Medicare, the federal health insurance program for individuals aged 65 and older, provides essential coverage for millions of Americans. However, scammers often target Medicare beneficiaries with fraudulent schemes designed to exploit their trust and steal personal information or money. In this blog post, we’ll explore the prevalence of Medicare scams and provide actionable strategies for protecting yourself from falling victim to these deceptive schemes.

Understanding Medicare Scams

Medicare scams can take various forms, but some common tactics used by scammers include:

-

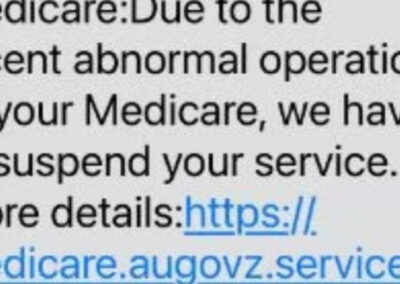

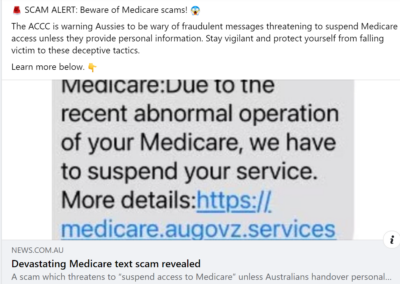

Phony Calls or Emails: Scammers may impersonate Medicare representatives or healthcare providers, contacting beneficiaries via phone calls, emails, or text messages. They may claim to offer new Medicare benefits, request personal information, or demand payment for services not covered by Medicare.

-

Medical Equipment Fraud: Some scams involve the sale of unnecessary or overpriced medical equipment or supplies to Medicare beneficiaries. Scammers may use aggressive sales tactics or false promises to convince individuals to purchase items they don’t need, billing Medicare for the costs.

-

Identity Theft: Scammers may steal beneficiaries’ Medicare numbers or personal information to submit fraudulent claims for medical services or prescription drugs. Identity theft can lead to financial losses and potential disruptions in healthcare coverage for affected individuals.

How to Protect Yourself from Medicare Scams

To safeguard against Medicare scams and protect your health and finances, consider the following preventive measures:

-

Guard Your Medicare Number: Treat your Medicare card like a credit card and only share your Medicare number with trusted healthcare providers. Be cautious of providing this information over the phone or online, especially if you didn’t initiate the contact.

-

Verify Caller Identity: If you receive a call from someone claiming to be from Medicare or a healthcare provider, ask for their name, organization, and contact information. Verify their identity by contacting Medicare directly or your healthcare provider’s office.

-

Review Medicare Statements: Regularly review your Medicare Summary Notice (MSN) or Explanation of Benefits (EOB) statements for any discrepancies or suspicious charges. Report any unfamiliar services or charges to Medicare or your insurance provider immediately.

-

Stay Informed: Educate yourself about common Medicare scams and the tactics used by scammers. Stay updated on the latest fraud alerts and warnings issued by Medicare, the Federal Trade Commission (FTC), and other relevant authorities.

-

Be Skeptical of Unsolicited Offers: Be cautious of unsolicited offers for medical services, equipment, or treatments that claim to be covered by Medicare. Research the legitimacy of the provider and verify the coverage with Medicare before agreeing to any services or payments.

-

Report Suspected Fraud: If you suspect Medicare fraud or have been targeted by a scam, report it to Medicare’s toll-free fraud hotline at 1-800-MEDICARE (1-800-633-4227) or the FTC’s Consumer Response Center. Reporting scams can help protect others and prevent further fraudulent activity.

Credit and finance corporation scams pose a significant threat to individuals’ finances and personal information, but with awareness and vigilance, you can protect yourself from falling victim. By researching thoroughly, reading the fine print, verifying credentials, protecting personal information, using secure channels, and trusting your instincts, you can safeguard your finances against fraudulent entities. Stay informed, stay protected, and achieve your financial goals with confidence in the Philippines’ dynamic financial landscape.